Step-by-Step Guide to VAT Registration in the UAE

On 1 January 2018, Value Added Tax was introduced in the UAE to grow the economy and generate new sources of income for the UAE’s growth. Since then, it has become mandatory for every business in the UAE to follow VAT rules as well as register for VAT within the given time; otherwise, you will have to pay AED 10,000 as a fine. Whether you own a small startup, a growing company, or a large corporation, it is necessary to understand how UAE VAT Registration works and how we can avoid fines.

This guide is professionally created to help you complete your UAE VAT registration. It will assist you with:

- Creating an FTA e-Services account – This is the first step before you can register for VAT.

- Filling out the VAT registration form accurately – We explain what information is required for each section.

- Understanding icons and symbols – Learn what the different indicators on the form mean as you go through it.

The process of making an e-Services account is quite similar to creating any other online accounts.

Why Businesses Need VAT Registration in UAE

Following the Law: VAT Registration is mandatory in UAE due to tax laws. If your business earns more than AED 375,000 in taxable supplies and you do not register within 30 days, you could face penalties. So, it is necessary to follow all the rules respectfully, as it helps you avoid extra costs and keeps your business trusted.

Better Financial Control: VAT registration helps you in keeping proper records of your sales as well as purchases, as required by the Federal Tax Authority (FTA). This helps you file taxes more accurately, understand your cash flow better, and keep your accounts clear and easy to follow

Business Benefits: VAT registration can also work in your favor. If the VAT you pay on business expenses is higher than the VAT you collect from customers, you may be eligible for a tax refund. This reduces your overall tax burden and can strengthen your financial planning.

Who Must Register for VAT in UAE

Any business, that operates in the UAE must register for VAT once its taxable sales and imports reach the required limit. The law allows 30 days to apply after crossing the threshold. Companies that don’t reach the mandatory limit can still choose to register voluntarily.

I) Mandatory VAT Registration

If your business has made taxable sales of more than AED 375,000 in the past 12 months, or if you expect to cross this amount in the next 30 days, VAT registraton is mandatory on your business. Taxable sales cover all goods as well as services sold in the UAE that are liable for VAT. Companies that do not register on time could incur fines and other penalties.

II) Voluntary VAT Registration

Businesses with taxable sales and imports exceeding AED 187,500 but not surpassing AED 375,000 have the option to register with FTA through Voluntary VAT registration. This option is useful for small businesses and startups because it allows them to recover VAT paid on their purchases and expenses.

How to Register for VAT with FTA (Step-by-Step Process)

Creating and Using Your FTA e-Services Account

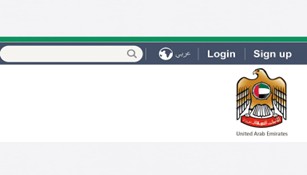

When you visit the FTA website, you’ll see an option in the top right corner of the page. From there, you can either create a new e-Services account by clicking on ‘Sign up’ or click on ‘Log in’ if you already have one.

Creating an e-Services Account for First-Time Users: To create a new account, go to the FTA homepage and select the option ‘Sign Up’.

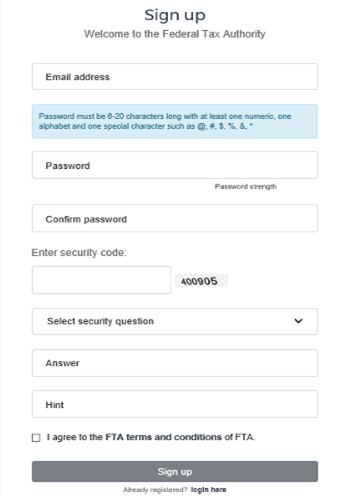

You will need to provide a valid email address and choose a strong password between 6 and 20 characters. The password must include:

- At least one number

- At least one letter

- At least one special character (such as @, $, #, &, %, or *)

You must also prove that you are a real user by completing a simple verification test, which includes both letters as well as numbers.

At last, you will need to choose a security question, write your answer, and add a hint. This helps you recover your password if you ever forget it.

Before you finish, carefully read and understand the FTA’s Terms and Conditions, then click ‘Sign Up’ to complete your account setup.

Verify Your Account: An email will be sent to the email address that you used during registration, asking you to confirm and verify it.

Once you are done with creating account, you have to verify your email within the period of 24 hours of creating the account. When your email is verified, your account becomes active, and you can log in to your account instantly. If you fail to verify within 24 hours, the verification link will eventually expire, and you will have to create the account again.

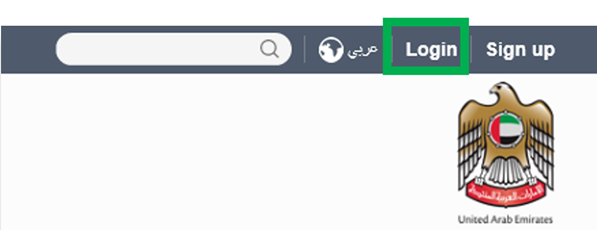

Accessing Your Account as a Registered User: After verification, you can log in simply with your chosen username and password.

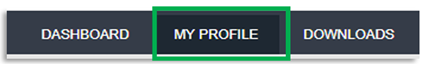

From your dashboard, you can easily access essential services such as:

- VAT Dashboard: An overview of your VAT registration and status.

- My Profile: Your account details and personal settings.

- Downloads: Helpful resources and guides for ongoing VAT compliance.

You can also update your password or security question at any time through the My Profile tab.

Changing Your Registered Email Address: Businesses sometimes need to update their email address linked to the FTA account. The process involves two steps:

- Verification of the new email address

- Submitting a request to the FTA

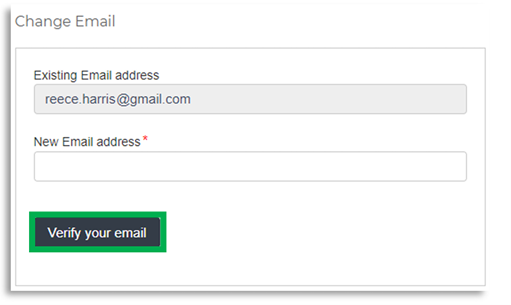

Verification of the New Email Address: To confirm your new email address, follow these steps:

- Log in to the e-Services portal and open the My Profile section.

- At the bottom left, you’ll find an option to add a new email. Provide your new email address and then click on ‘Verify your email’.

- An email will then be sent to the new address with a verification link.

- Open the email you received and click the ‘Verify your email’ link to confirm your address.

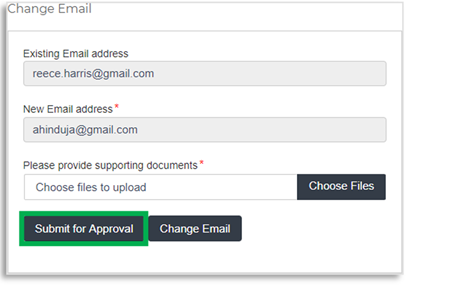

Submitting a Request to the FTA: After confirming your new email, you need to submit a change request to the FTA. Here’s how:

- Log in to the e-Services portal using your old email and open the My Profile tab.

- Upload the required supporting documents so the FTA can review your request, then click ‘Submit for Approval’.

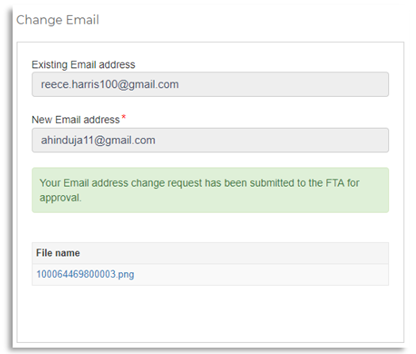

- The FTA usually reviews and updates your email within five business days. Once approved, all future VAT-related notifications will be sent to your new email address.

You will need to provide the following documents:

- A letter on the company’s official letterhead, signed and stamped by an authorized signatory. The letter should request the email change and include details such as the name, email address, and passport number of both the old and new email holders. It must also show the company stamp and contact information.

- Passport copies of old and new email holders.

- Emirates IDs of old and new holders (if available).

Important: After your new email is updated in the system, you won’t be able to log in with your old one anymore. From that point on, you must use the new email to access the e-Services portal. If you ever want to switch back to your old email, you’ll need to repeat the same steps again.

Also, keep in mind that all notifications linked to your Taxable Person account will be sent to your updated email address.

Complete the VAT Registration Form

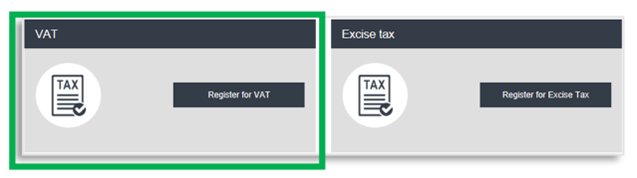

After signing in to your account, an option will appear to apply for VAT. Simply select this option to begin your VAT registration (sometimes you may also see an option for Excise Tax).

Important: If your business needs to register for both VAT and Excise Tax, make sure you complete both applications within the required deadlines. Missing the timeline can lead to fines for late registration. Once you receive your Tax Registration Number (TRN) for one tax type, you can start the second application, and some of your details will already be filled in automatically.

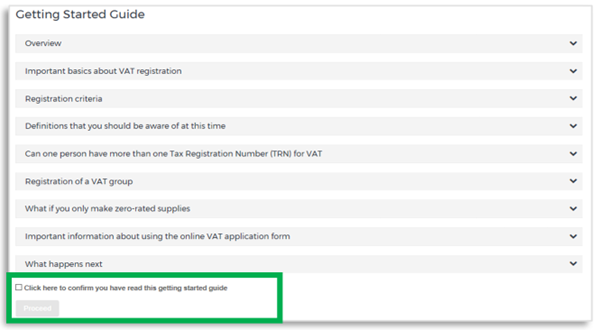

VAT Starter Guide: When you press the ‘Register for VAT’ button, a short guide will open. This guide explains the main requirements for VAT registration in the UAE and breaks them down into simple sections for easier understanding.

The guide also highlights the documents and information you should keep ready before starting the form. Carefully read each part. Once finished, you will need to tick the box confirming you have read the guide before moving ahead with your application.

Click ‘Proceed’ to start your form of VAT registration.

How You Can Fill Out the VAT UAE Registration Form: The VAT registration form is divided into 8 different sections that you have to fill out completely. As you move through the form, your progress will be tracked. The section you’re working on will be highlighted, and once a section is finished, it will turn blue with a green check mark.

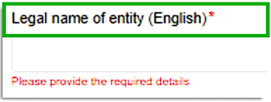

To move forward to the next part of the form, you must complete all the required fields in the current section. Any field marked with a red star (*) is mandatory and cannot be left blank.

If you try to continue without filling in a required field, a pop-up message will appear under that field to let you know that more information is needed.

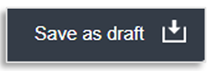

Saving Your Details: While filling out the form, remember to save your progress by clicking the ‘Save as draft’ button at the bottom. If you stay inactive for 10 minutes, the system will log you out automatically.

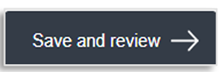

After completing all required fields, press the ‘Save and review’ button in the bottom-right corner to continue to the next section.

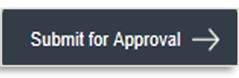

Submitting Your Application UAE VAT Registration: After clicking ‘Save and review,’ go through all the information on your VAT registration form to make sure it is correct. Once you are sure everything is accurate, click the ‘Submit for Approval’ button at the bottom right of the screen.

After submitting your application, the Dashboard will show its status as ‘Pending.’ You will also receive a confirmation email notifying you that your application has been successfully received and is under review.

If the FTA needs more information to verify your application, you will get an email explaining what details they require from you.

Tracking the Status of Your Application: To check the status of a VAT registration, the user can go to the Dashboard and view the Status:

Drafted – The form has been started but not submitted.

Pending – The form has been received and is under review, or additional information is being requested.

Issued – You have been issued a Tax Identification Number (TIN). TINs for Tax Group registrations end with ‘VG,’ while TINs for VAT exemptions end with ‘XC.’

Suspended – The VAT registration has been temporarily paused. Your Tax Group registration has been approved, and a TRN has been issued.

Rejected – It means that your registration form was not approved.

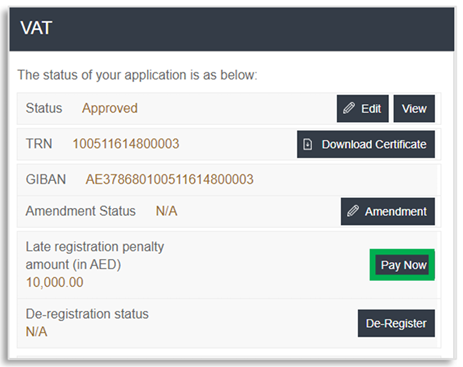

Approved – The registration has been successfully approved, and the user is now officially registered for VAT.

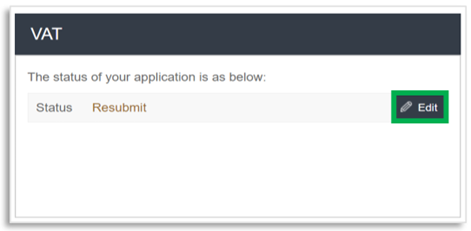

Resubmitting the Application: If the FTA requests the applicant to resubmit the application, they can open the form by clicking the ‘Edit’ button. The applicant can also add any comments or questions about the application at the bottom of the form.

VAT Registration After the Deadline: If a Taxable Person misses the deadline for submitting a registration application as set by the Tax Law, they will have to pay 10,000 AED administrative fine. To view the penalty details and pay the amount, follow the steps below:

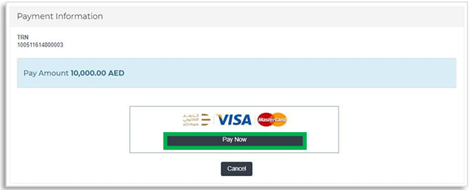

- Open the Dashboard tab, and under the VAT section, you will see the amount for the ‘late registration penalty.’ Select the ‘Pay Now’ button to continue with your payment.

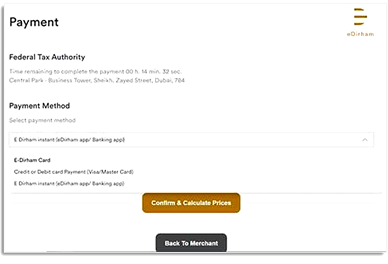

- After that, you will be redirected to the e-Dirham payment gateway, where you can pay using either an e-Dirham card or a regular card.

- After the payment process is finished, it will appear in the ‘Transaction History’ section under the ‘My Payment’ tab.

Why Choose Vertix Auditing for VAT Registration in UAE

There are many rules, deadlines, and technical procedures involved in UAE VAT Registration process. Seek professional assistance if you want to avoid common registration errors. This will ensure accuracy and make the process faster and quicker. Experts will verify your documents, assist you in every step, and ensure everything is properly done in order to prevent errors and fines. If you are looking for reliable VAT Registration in the UAE, then contact Vertix Auditing to get professional help and latest updates via contact@vertixauditing.ae.

Last Modified: