Step-by-Step Guide to VAT Filing in UAE

This guide is created to comprehensively explain the users how to use the e-Services portal to file your VAT Return (Form VAT201). It is recommended to read this guide together with the Taxable Person Guide for VAT because it makes easier for you to understand the filing process and other key details.

- With this guide, you can understand how to manage your VAT requirements, along with VAT tax filing, paying tax, and claiming VAT refunds.

- Understand the meaning of the icons as well as symbols that you need to use in order to file the form.

VAT Return is the official document that a Taxable Person is obligated to complete and submit to FTA at regular intervals. This document clearly shows how much VAT a business has charged (output tax) and what is the amount that the business can claim back (input tax), along with other required details.

All VAT Returns must be filed online simply by using FTA portal. It can be submitted either by the business itself (the Taxable Person) or by someone who is authorized to do it on their behalf, such as a Tax Agent or Legal Representative.

What are the Important Notes about the VAT Return?

Tax Period

- A Tax Period refers to the specific duration in which Payable Tax is required to be calculated as well as paid.

- A business usually has a 3 month tax period that ends on a date set by the FTA. However, this 3 month time is not fixed for everyone, the FTA may ask certain companies to file their VAT returns every month instead of every 3 months.

- If the standard 3 month tax period is being followed, the business has the right to request the FTA to set the tax period to end in a specific month (for example, ABC company request FTA to end the tax period in March). The FTA may approve or reject this request.

- The VAT Return in UAE must be submitted to FTA no later than the 28th day after the end of the Tax Period, or by another date specified by the FTA. Any payment due must also reach the FTA by that same deadline.

If the deadline (last date) to submit a VAT Return is on a weekend or a national holiday. In this case, the submission date is extended to the next business day.

There are total 4 Tax Period cycles (also known as staggers) from which you have to follow one (unless the FTA decides otherwise):

| Stagger: | Tax Periods: | First Tax Period in 2018: | First Due Date: |

| VAT Stagger 1

(Tax Year End: 31 January each year) |

Feb–Apr

May–Jul Aug–Oct Nov–Jan |

1 January 2018 to 30 April 2018 | 28 May, or the next working day if this falls on a weekend or public holiday |

| VAT Stagger 2

(Tax Year End: Last day of February each year) |

Mar–May

Jun–Aug Sep–Nov Dec–Feb |

1 January 2018 to 31 May 2018 | 28 June, or the next working day if this falls on a weekend or public holiday |

| VAT Stagger 3

(Tax Year End: 31 March each year) |

Apr–Jun

Jul–Sep Oct–Dec Jan–Mar |

1 January 2018 to 31 March 2018 | 28 April, or the next working day if this falls on a weekend or public holiday |

| VAT Stagger 4

(Tax Year End: 31 December each year) |

Monthly | 1 January 2018 to 31 January 2018 | 28 February, or the next working day if this falls on a weekend or public holiday |

If your business does not have any transactions during the Tax Period, you are required to submit a “nil” VAT Return by the deadline.

Understanding the Tax Liability

Here you will learn about some important terms which are related to VAT filing, and you will get to know how they can impact a tax liability.

Output Tax: Output tax is VAT that a business charges to its customers on the supplies of goods and services it sells once it is registered for VAT. Usually, this tax applies to sales made to customers, but sometimes VAT also applies to certain transactions that are treated as sales for VAT purposes or under the reverse charge mechanism (RCM).

The business must report output tax at the tax point, which is the date the supply is made. Once this date occurs, the output tax must be included in the VAT Return for that Tax Period.

Input Tax: Input tax is the amount of VAT that is added to the price of goods or services (that are subject to VAT) by the supplier. If the buyer is registered for VAT, in this case, they may be able to reclaim this VAT from the FTA, as long as:

- They have received as well as kept a tax invoice or other proof showing the VAT charged.

- The VAT has been paid, or will be paid, either fully or partially (if the VAT is partially paid, then you will only be able to reclaim that portion).

If you meet these conditions, then you can easily include the input tax as a deduction in your UAE VAT Return.

Calculating Tax Liability

A registered business’s VAT liability is basically the difference between the VAT it charges customers (called output tax) and the VAT it pays on its own purchases (called input tax) during a tax period.

If the output tax is higher than the input tax, then it is the responsibility of a business to pay the difference to FTA. Whereas, if the input tax is higher than the output tax, then the business can request a VAT refund from FTA.

Filing VAT Returns

For every tax period, you need to submit a VAT return which contains the lists of your sales and purchases.

For sales (outputs), you will need to report:

- All goods and services sold at the standard VAT rate in each Emirate.

- Any VAT refunds given to tourists under the official refund scheme.

- Transactions subject to reverse charge.

- Zero-rated and VAT-exempt supplies.

- Goods imported through UAE Customs, including any adjustments made later.

For purchases (inputs), you must report:

- Business expenses where VAT was paid, and you want to claim it back.

- Reverse charge supplies where you want to recover VAT.

Finally, check the amount of VAT charged as well as the VAT that you reclaimed, then calculate the difference between them. This is the amount you must pay or will receive as a refund.

Process to File VAT Return in UAE

If you are registered for VAT, you must report and pay the VAT you owe in your VAT return for the period when you made and received those supplies.

Initiate the Form

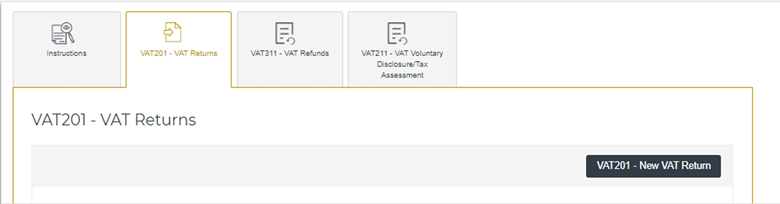

To start your VAT return filing, you have to log in to the FTA e-Services portal simply by using the username along with password that you registered for your portal. Then, you have to click on the VAT tab which will appear on the navigation bar. After this, go to “VAT201 – VAT Returns,” option and select “VAT201 New VAT Return” to open the form (refer to the picture shown below for better understanding).

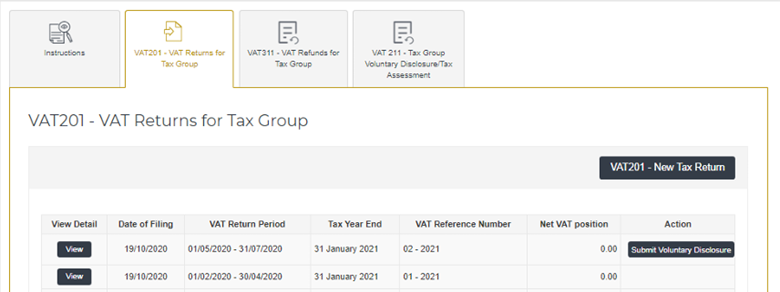

If you have registered a Tax Group and act as its representative, you can create and access the VAT Return through the “VAT201 – VAT Returns for Tax Group” tab.

If you are a member of a Tax Group, then you can just view the VAT Returns submitted by the group’s representative.

Complete the form

The section below will guide you about the information you need to fill in each part of the form.

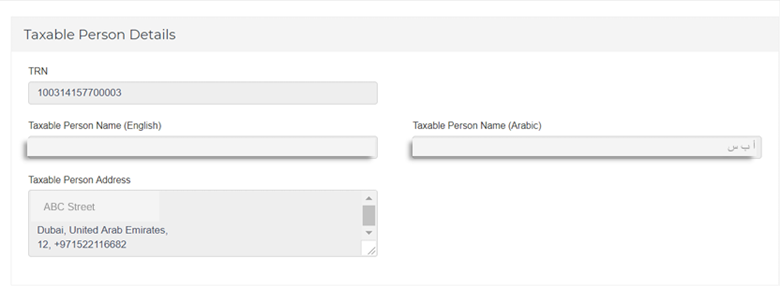

Taxable Person Details

In this form, the Taxable Person’s details, including their TRN, name, and address, will automatically be filled, so you don’t need to fill these.

If a Taxable Person appoints a Tax Agent or Tax Agency, their information will also appear. This includes the Tax Agent’s approval number (TAAN), the Tax Agency number (TAN), and the names of both the Tax Agent and Tax Agency.

You will also see the VAT filing due date. Make sure all this information is correct. It is recommended to verify it first, before moving further.

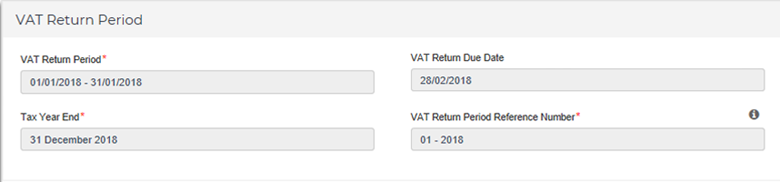

VAT Return Period

The form will automatically show the VAT Return Period, Tax Year end, and the VAT period reference number. The Tax Year end is important for businesses that can’t recover all their VAT and need to make an annual input tax adjustment for the unrecovered VAT in the first return after the year ends. The VAT period reference number indicates which tax period you are filing. For example, if it is 1, businesses should include their annual adjustment in this return.

Note: Please keep this thing in mind that this is only needed from the second year of VAT onwards, starting 1 January 2019.

Key Requirements for Filling Out the VAT Return

While filling the VAT Return, you should keep these things in mind:

- Enter all the amounts in UAE Dirhams (AED)

- Round off the amounts to the nearest fils (the form allows two decimal places)

- Fill all the mandatory fields

- Enter “0” if there is nothing to declare in a field

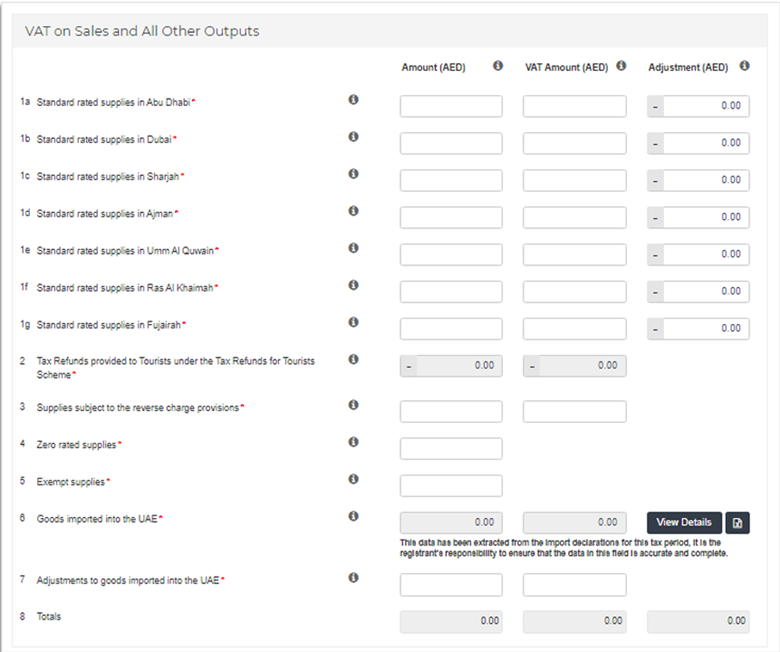

VAT on Sales and All Other Outputs

Enter the amount details on sales and all other outputs as follows:

Amount (AED): Enter all sales and output amounts excluding VAT and report them for each Emirate as required by the VAT laws.

You should also account for value reductions from credit notes and any errors you are allowed to fix from previous tax periods. If you discover an error, check whether it requires a voluntary disclosure under Federal Tax Procedures. However, if the error caused your payable VAT to be lower than the correct amount by AED 10,000 or less, you can fix it in your current VAT return.

In the “Amount” column, report only the net correction amount, excluding any VAT.

If the mistake means you owe more than AED 10,000 in unpaid tax, you must submit a Voluntary Disclosure to report and correct the error.

VAT Amount (AED): Enter the VAT amounts for sales and other outputs for each Emirate, where applicable. Include any reductions from credit notes and correctable errors from previous tax periods.

If you find an error in a previous VAT return that caused your payable tax to be lower by AED 10,000 or less, you can fix it in your current VAT return. In the “VAT Amount” column, report only the VAT portion of the correction. However, if the error caused your payable tax to be lower by more than AED 10,000, you must submit a Voluntary Disclosure to correct it.

Adjustment (AED): Use this column to record adjustments to output tax for bad debts. Enter only VAT amounts, which must be negative, and report them for each Emirate as needed.

You should also use this column for adjustments related to sales of commercial property. If you sold a taxable property during the tax period and the buyer already paid the VAT directly to the FTA, record that VAT here. This ensures the tax is not counted twice. All entries must be negative VAT amounts, reported for the Emirate where the property is located.

If you are not claiming VAT Bad Debt Relief or making a real estate adjustment, leave the “adjustment” column blank.

Box 1 – Standard Rated Supplies

The purpose of the first box is to enter your sales in UAE, that have 5% VAT. Enter your sales separately for each Emirate, such as Dubai, Abu Dhabi, or Sharjah, etc. Enter the total sales amount (without VAT) and the VAT charged.

Example: If you sold AED 50,000 worth of products in Dubai, the VAT will be AED 2,500. So, you report AED 50,000 as the value and AED 2,500 as the VAT.

Please include the following:

- Sales of goods and services that are charged 5% VAT

- Sales of goods and services, including discounted sales (after deducting the discount value)

- Deposits received as part payments and sales through vending machines

- Supplies of commercial property and inter-company sales (if not in a tax group)

- Staff supplies like canteen sales or private-use charges

- Sale or deemed supply of business assets (including gifts or private use of business items)

- Goods and services owned at the time of deregistration

- Reimbursements of expenses recharged to customers

- Goods sold under the profit margin scheme (VAT due only on profit)

- Sales by non-resident VAT-registered persons where the importer doesn’t pay VAT

- Supplies consumed within Designated Zones

- Reduce the value for credit notes or small errors (up to AED 10,000). If the error is more than AED 10,000, you must file a voluntary disclosure.

Please exclude the following:

- Sales from Designated Zones that are not used or consumed inside the zone

- Out of scope supplies

- Zero-rated sales, such as exports, approved education, or healthcare services

- Disbursements

Box 2 – Tax Refunds for Tourists

If your business is registered under the UAE’s Tourist Refund Scheme, the VAT refund amounts given to tourists will appear automatically in this box. These amounts, shown as negatives, will reduce your total VAT due. You won’t be able to edit the values in this section.

Note: Only businesses that are part of the Tourist Refund Scheme will see amounts in this box. If your business isn’t registered for the scheme, this box will automatically show zero values.

Box 3 – Supplies Subject to Reverse Charge

Here you enter the value of any goods or services you bought that are taxed under the reverse charge rule. This usually means services you received from outside the UAE, where you must pay the VAT instead of the supplier. Do not include goods already declared to UAE Customs. In most cases, this box is only for imported services. Only list imported goods here if they were not declared at Customs. Enter the total amount (without VAT) and the VAT you owe. If you can claim that VAT back, include it later in Box 10.

Box 4 – Zero-Rated Supplies

In this section, you have to enter your sales with 0% VAT, these are generally known as zero-rated supplies. These sales can include exports outside UAE, international transport, as well as approved education or healthcare services. Enter only the total sales amount (VAT should not be included in this amount).

Box 5 – Exempt Supplies

List all your exempt sales in this box. Enter only the total amount (without VAT) because no VAT is charged on these supplies.

Please include the following:

- Local financial services

- Sale or rent of residential property (not zero-rated)

- Sale of bare land

- Local passenger transport services

Box 6 – Goods Imported into UAE

Box 6 shows the net value as well as VAT charged on goods imported into UAE. These values are usually filled automatically based on your customs declarations linked to your TRN. The ‘Amount (AED)’ field shows the customs value, duties, and excise tax, while the ‘VAT Amount (AED)’ field shows the 5% VAT automatically calculated on that total. You have to carefully verify that everything matches your own records.

Box 7 – Adjustments to Goods Imported in UAE

It is used to make adjustments when the pre-filled import data in Box 6 is incomplete or incorrect. Its primary purpose is to allow you to add any imports that were missing, remove any that were listed in error, or correct the VAT amount, for instance, if your imported goods were actually subject to a 0% rate instead of the standard 5%. This box helps you report accurate figures and explain any changes to FTA.

Box 8 – Totals

Box 8 automatically totals the VAT and adjustments from the outputs section. It shows the total output VAT for the period before deducting input VAT.

Box 9 – Standard Rated Expenses

Use this section of the return to claim back the VAT you have paid on your regular business expenses, such as office supplies, rent, or services. You must list the total cost of these purchases (without the VAT) in one column, and the corresponding VAT amount you wish to recover in another. Examples include rent, utilities, office supplies, advertising, and professional services. You must have valid tax invoices for these purchases. Don’t include any personal or non-recoverable expenses like entertainment or personal vehicle costs. Enter both the total purchase amount (without VAT) and the VAT you’re claiming.

Box 10 – Reverse Charge Expenses (Input VAT Recovery)

In Box 10, you can claim back the VAT you paid under the reverse charge system (from Boxes 3, 6, and 7). If you are eligible to recover that VAT, include the total value of the expenses and the recoverable VAT. Don’t include any VAT that can’t be claimed back.

Box 11 – Totals

This box adds all the VAT you can claim back from the FTA. It is the total amount of VAT from Boxes 9 and 10. Before submitting your return, check that the figure matches your purchase records and that all tax invoices are valid and complete.

Net VAT Due

The fields below show the VAT amount you need to pay for the tax period.

Box 12 – Total Value of Due Tax for the Period

The total VAT due for the tax period is automatically calculated by adding up the VAT and adjustment amounts from the Outputs section.

Box 13 – Total Recoverable Tax for the Period

The total recoverable VAT for the tax period is automatically calculated by adding the VAT and adjustment amounts from the Inputs section.

Box 14 – Payable Tax for the Period

This shows your net VAT for the period. If Box 12 is higher than Box 13, you need to pay the difference. If Box 13 is higher, you can either get a refund or carry it forward to use later.

Box 15 – Do you Wish to Request a Refund for the Above Amount of Excess Recoverable Tax

If you have extra VAT to claim back, you can choose to request a refund in your VAT return.

- Select “Yes” to apply for a refund after submitting your return (using Form VAT311).

- Select “No” to carry it forward and use it to reduce future VAT payments or penalties.

Additional Reporting Requirements

The additional reporting section is not for everyone, it only applies to certain businesses. If it doesn’t apply to you for this tax period, you simply have to select “No.”

This section won’t change your VAT payable or refundable amounts, as it doesn’t affect your VAT return totals.

Profit Margin Scheme

You need to confirm whether you used the Profit Margin Scheme during this tax period or not. Select Yes option only if you actually applied the scheme while filing this VAT return.

Declaration and Authorized Signatory

After completing your VAT return, check the box next to the declaration section.

The Authorized Signatory details will appear automatically, using the information already saved in your tax records.

Save the Progress

After completing the form and answering all the mandatory fields, save your progress simply by clicking on Save as draft button as shown in the picture. By this step, your form will be saved (not submitted), so you can edit it later on. It is crucial to save as draft because if you are inactive for 10 minutes, you will be logged out automatically.

Submit UAE VAT Return Form

Before the submission of your form, you must make sure that you have filled all the mandatory fields that are marked with a red asterisk (*). Check every field thoroughly and then press Submit button as shown in the picture above.

If you miss any mandatory field, a message will appear on the screen informing you what is missing in the form. After submitting the form, you will receive a confirmation email. Sometimes, it is possible that the email only appears in the spam folder, so check your spam folder if you don’t see it within a few minutes.

Paying VAT

Paying VAT is another significant topic. If you want to learn about Paying VAT, then please check the online payment guide.

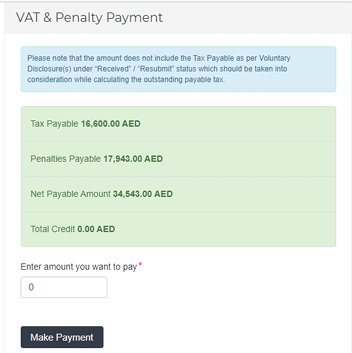

VAT Penalties

- VAT returns should be submitted within the deadline prescribed by FTA. If you miss the deadline, a penalty of AED 1,000 will apply for the first time. If you delay again within 24 months, the fine increases to AED 2,000 for each late submission.

- If you miss the deadline, the FTA may issue an estimated tax assessment, and you will need to pay the tax plus any late filing or payment penalties.

- A late payment penalty of up to 300% may apply: 2% the day after the due date, then 4% per month on any unpaid amount.

Make Payment for VAT Penalties

For those who don’t file or pay VAT return in given time, keep in mind that this will cause you a penalty. If you want to pay the penalties, simply open the portal, then go to My Payment tab. Here you can check and pay the amount under VAT & Penalty Payment.

To read details about the amount and penalty type, scroll down the page and proceed to My Payment tab. Open the Transaction History box and check the relevant details.

Final VAT Return

If your VAT deregistration has been successfully approved by the authority, then you will receive confirmation along with the date on which your VAT registration will officially end.

You must:

- File your final VAT return for the last tax period before deregistration.

- Submit it by the due date set based on your deregistration date.

- You must follow the same process as regular VAT returns.

- Include output VAT on any business assets (like stock or equipment) you still own and previously claimed input VAT on, even if you haven’t sold them.

Last Modified: