VAT Deregistration in UAE

A business that is registered for UAE VAT must inform the FTA about VAT deregistration within 20 working days from the end of the month when either of the below happens:

- The business stops making taxable sales

- The total taxable sales in the last twelve months fall below the Voluntary Registration Threshold

The FTA will approve deregistration if they are satisfied that:

- The business has stopped making taxable sales or supplies and does not plan to make any in the next 12 months; or

- The business’s taxable sales or expenses in the past 12 months are below the threshold for voluntary VAT registration, and it does not expect these to exceed the threshold in the next 30 days.

A business will be deregistered from VAT either on the last day of the tax period within which it qualified for deregistration, or on another date decided by the Federal Tax Authority. To be deregistered, the business must first submit all tax returns as well as clear any payments it owes to the tax authorities.

If a business is not legally required to cancel its VAT registration or not required to deregister for VAT, it can still request for voluntary deregistration if its taxable supplies over the last 12 months are below the mandatory VAT registration threshold. But if your business registered for VAT voluntarily, it must wait for at least 12 months from the registration date before it can apply for deregistration. In order to apply for VAT deregistration, please follow the below step-by-step guide:

Steps for VAT Deregistration in UAE

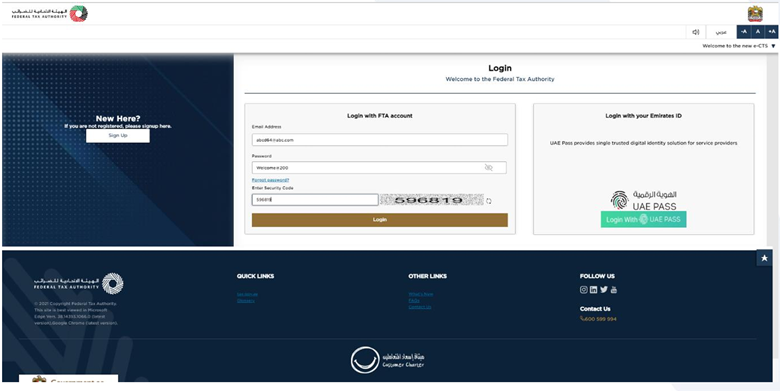

Login to EmaraTax

There are 2 ways to log in to your EmaraTax account. First, by using your username and password, and second, by using UAE Pass. If you currently don’t have an EmaraTax account, then simply click Sign Up button to create a new account. Sometimes, users forget their EmaraTax account password and can’t recall it. In this case, just use the Forgot Password option to reset it and regain access to your account.

When you log in by using your registered email and password, your user dashboard will be displayed. Whereas, if you have enabled two factor authentication, then you will receive an OTP on your registered email and mobile number. You have to enter the OTP in the given space to successfully access your account.

Similarly, if you choose to log in through UAE Pass, then you will be redirected to UAE Pass page. You will approve the login request by entering your UAE Pass Pin code. Upon successful login, you will be redirected back to your EmaraTax dashboard automatically.

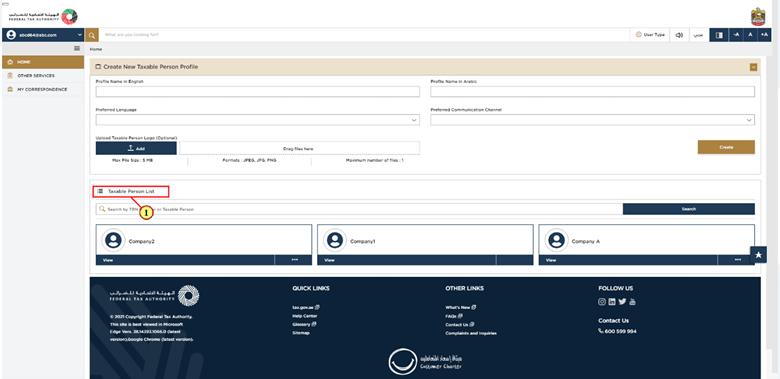

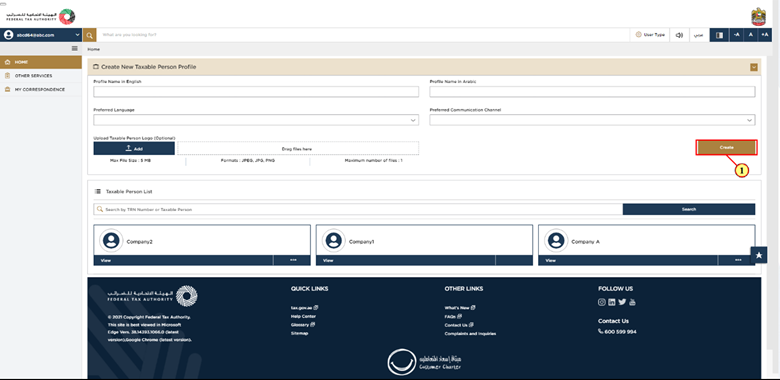

After you have logged in successfully, you will see the Taxable Person list, which shows all the Taxable Persons linked to your EmaraTax account. If the list is empty, then this means there are no Taxable Persons linked yet, and you will need to create a Taxable Person to proceed.

To add a new Taxable Person, you just need to provide the details shown on your screen and then click on Create button. By this step, the new Taxable Person will be added to your list.

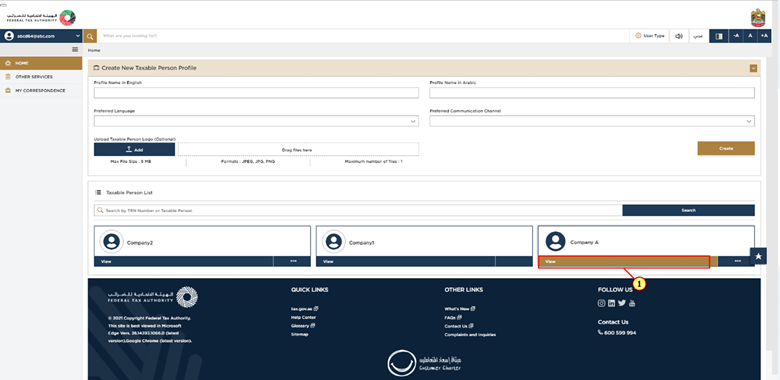

Choose the Taxable Person from the list and click on View option to open the dashboard.

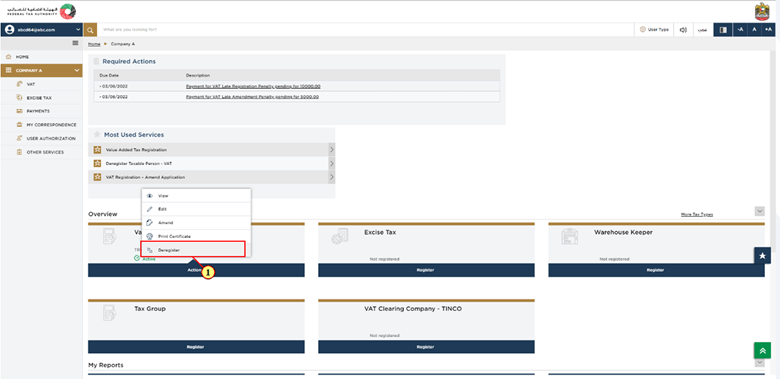

VAT Tile

In order to begin the VAT Deregistration process, you will see an option of Actions on the VAT tile. Simply, click on it and select the Deregister option.

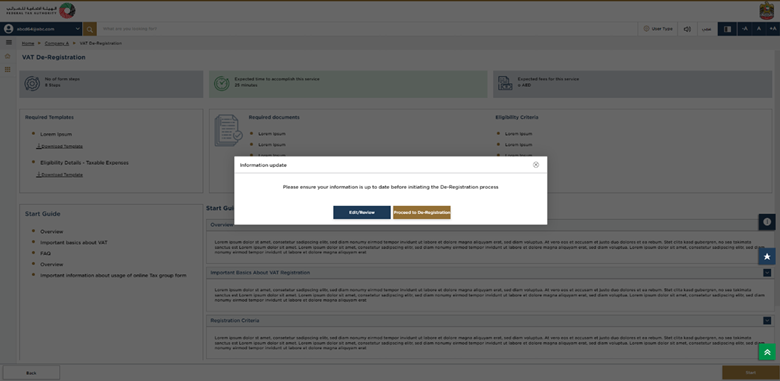

Information Update

If there is anything that you need to change in your bank details, then click on Edit/Review option. Otherwise, click on Proceed to De-Registration option.

If you are registered in the Tourist Refund System (TRS), it is possible for you to submit your deregistration application. However, it won’t be fully processed until you have completed deregistration from TRS.

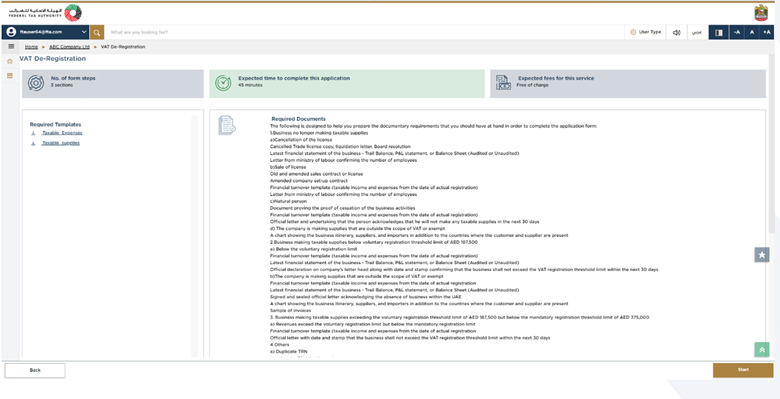

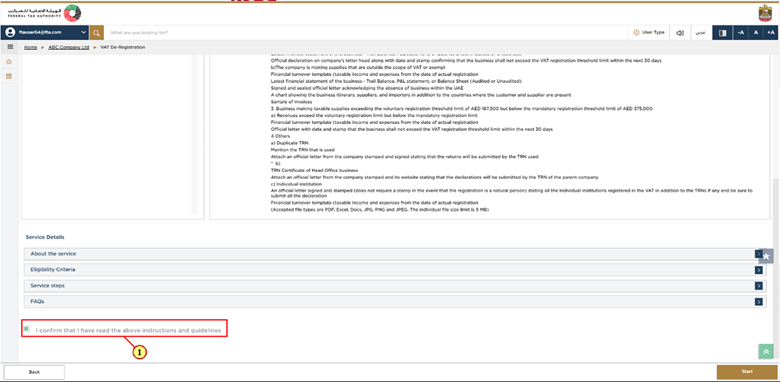

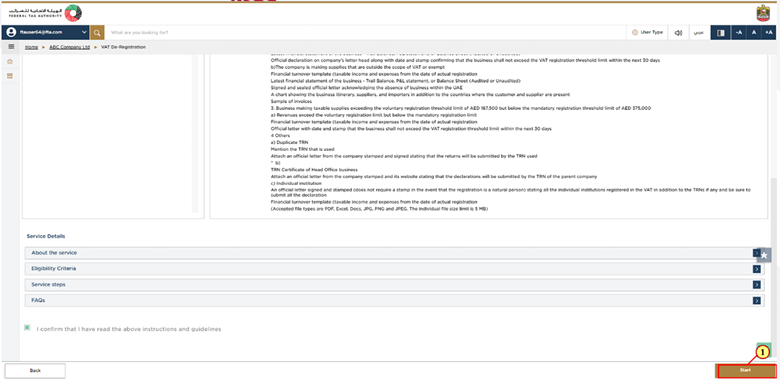

Guidelines and Instructions

The guidelines and instructions page is basically designed in a way to help users understand the key requirements for VAT Deregistration in UAE. It is also helpful because it provides guidance on what information the user should have in order to complete the deregistration process and application.

After reading all the instructions carefully, you have to mark the checkbox in the left corner of the screen for confirmation.

You see an option of Start in the bottom right corner of your screen, click on it to begin your VAT Deregistration application.

De-Registration Information

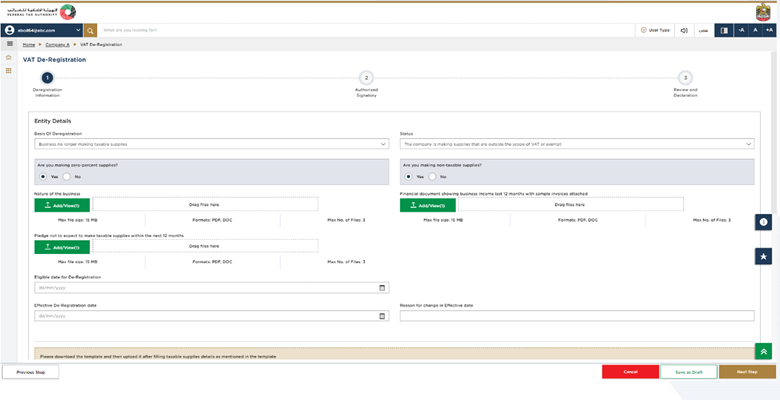

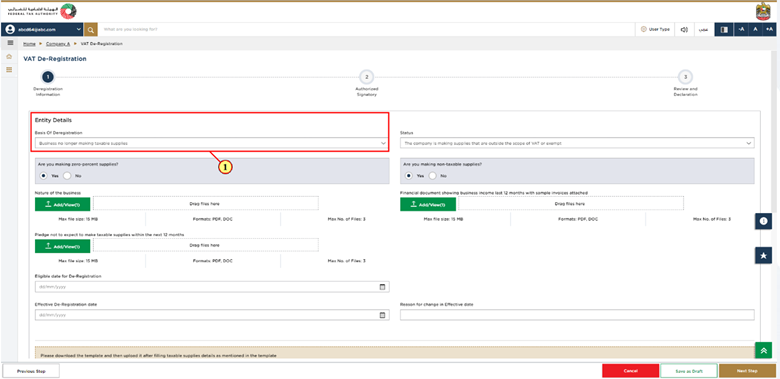

From here, the main part of deregistration starts. The application is divided into several short sections that contain the details of different parts of the deregistration process. On the top of the page, there is a process bar that shows the number of sections you need to complete. The process bar section will be shown in blue color if you are working on that particular section, and when you complete it, it will turn green as you move to the next section.

It is necessary to fill all the mandatory fields in order to move to the next section. Optional fields are clearly marked as “optional” next to their names.

Please ensure and verify that the documents you upload should match the information you have entered in the application. By carefully examining the same, you can avoid rejection and prevent delays.

The taxpayer’s VAT registration details are automatically filled and populated on the deregistration form.

Select the basis on which you are deregistering from VAT. Depending on the reason you select for deregistration, the relevant fields and sections will appear on the screen. You will need to fill in the required details and upload all the necessary supporting documents. Different reasons have different requirements, and according to your selection you will be required to prepare and provide the requested information.

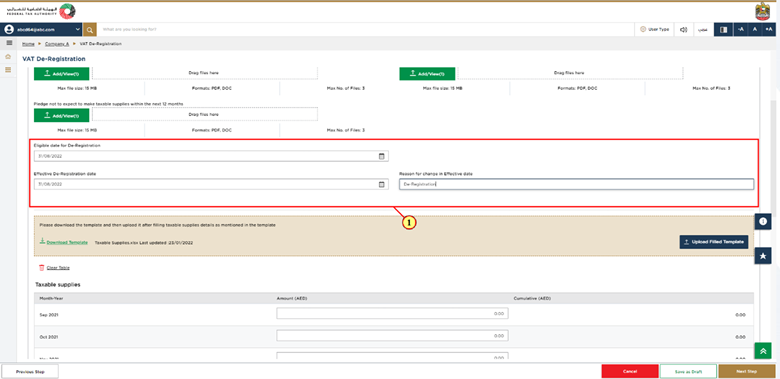

The date when a Taxable Person can or must deregister depends on the reason chosen for deregistration. Enter the date you are eligible for deregistration. EmaraTax will then automatically fill in the effective deregistration date based on the date you entered. If needed, you can change the effective deregistration date but you will need to provide a reason for the change.

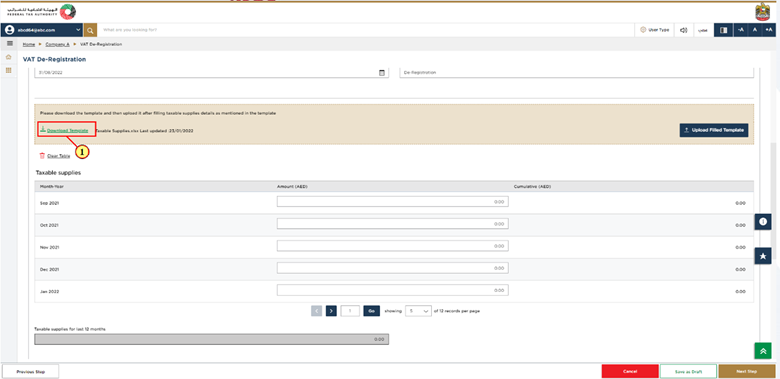

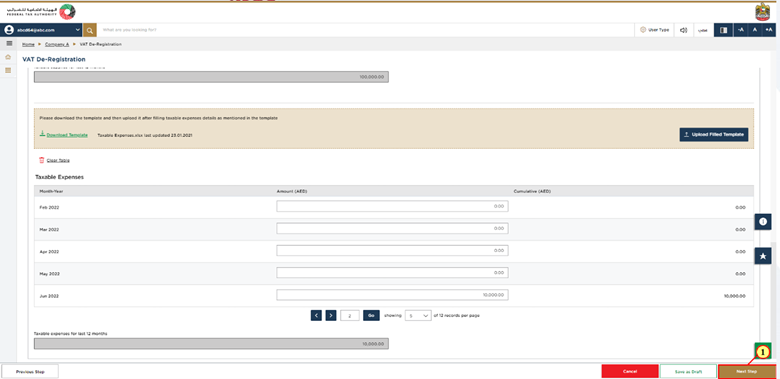

You need to provide details of your taxable supplies and expenses to support your deregistration application.

There are 2 ways in which you can enter your taxable supplies and expenses.

- Download the Excel template, fill in the required details, and upload it again. The information will automatically appear on the screen. OR

- Enter your taxable supplies and expenses directly on the screen.

All amounts must be entered in UAE Dirhams (AED) only.

Click on the Next Step button in the bottom right corner of the page to save your progress and move to the Authorized Signatory section.

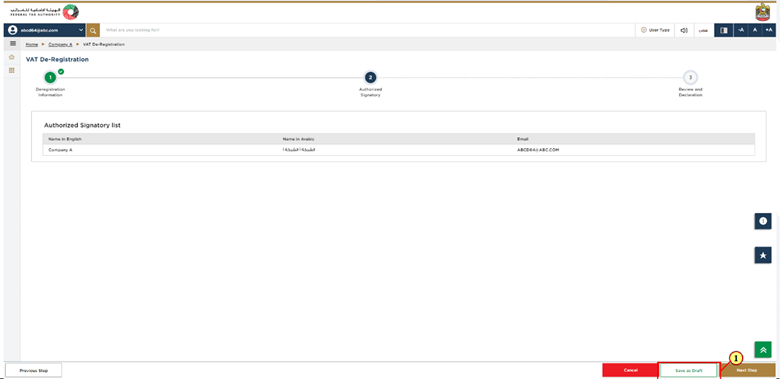

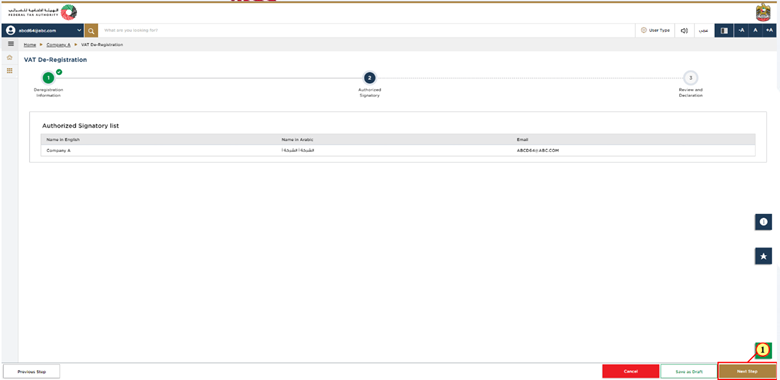

Authorized Signatory

Click on Save as Draft option to save your application so that you can come back and continue it later. This is only in case you want to continue your deregistration application later on and want the information you have already provided to be saved. Note, it is generally preferred to always save your application.

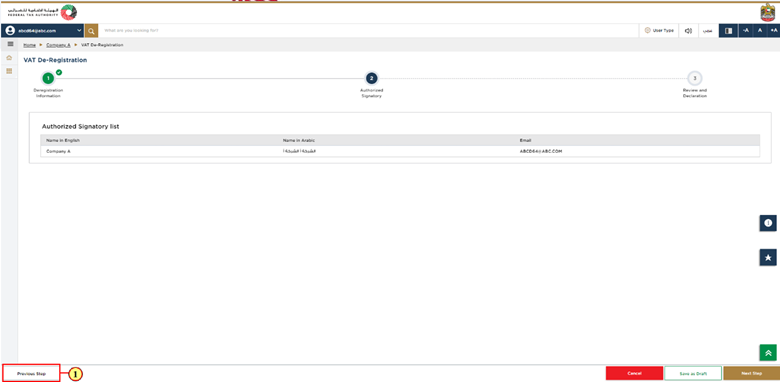

If you want to go to the previous section, click on Previous Step to return to the previous section.

Check the authorized signatory details, then click Next Step option to save as well as move to the next section.

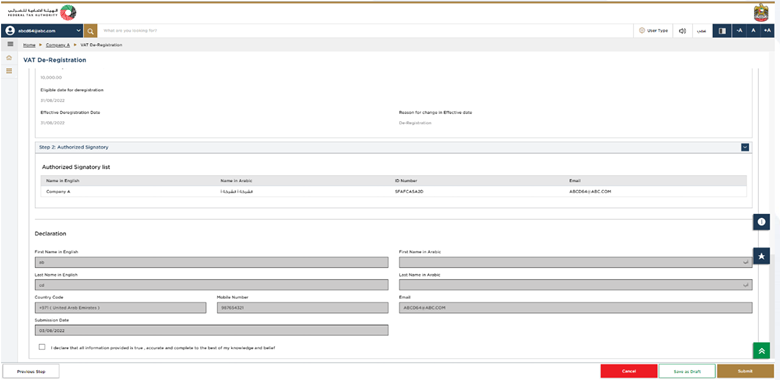

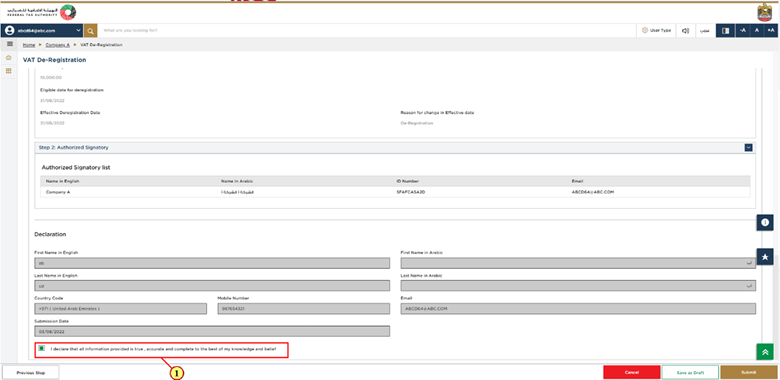

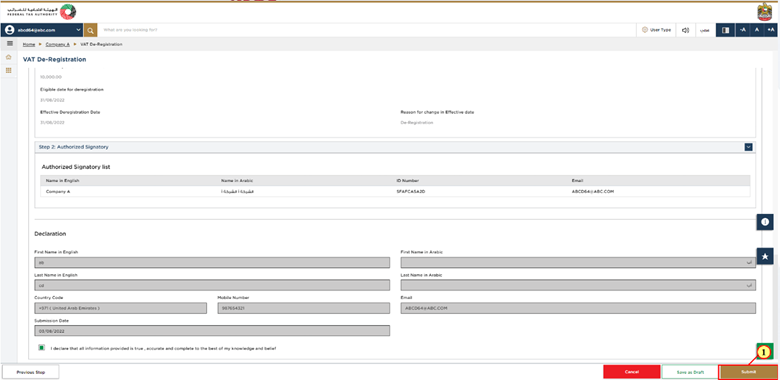

Review and Declaration

This is the final step which shows all the details you have entered in the application for VAT deregistration. Please review everything carefully and in case any change is required, make that change before you submit the application.

After reviewing all the information in your application, mark the checkbox in the bottom left corner to confirm that the details you have provided are correct.

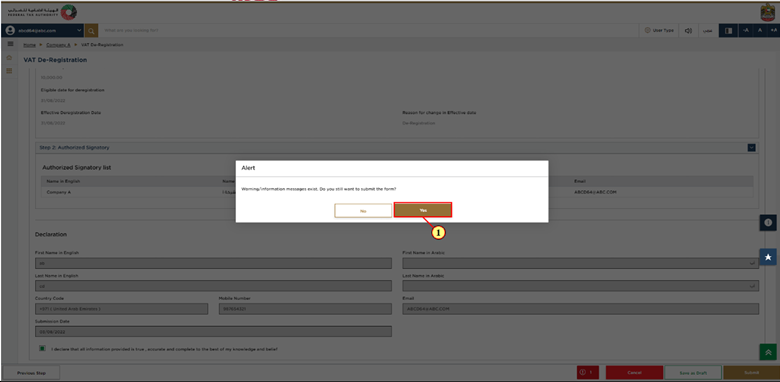

Click on Submit button to conclude your VAT Deregistration application.

Click on Yes button to continue.

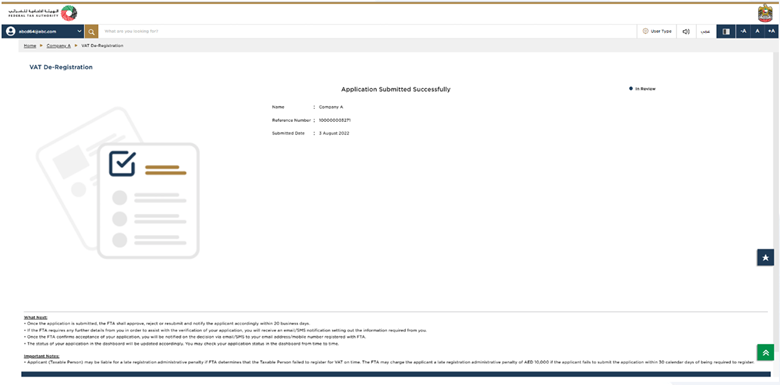

Post Application Submission

After the submission of your application, a Reference Number will be generated for your submitted application. You should keep this number saved with you for future communication with the Federal Tax Authority.

Next Steps:

- The FTA will review your request and may approve, reject, or ask for more documents.

- You can track the status on your dashboard and will be notified once it’s pre-approved.

- You may need to file a final tax return and settle any pending payments.

- Deregistration will only be completed once all the dues are cleared and returns are filed.

- If you have a credit balance, apply for a refund through EmaraTax.

Failure to Inform FTA About Value Added Tax Deregistration

If a taxable person does not apply for VAT deregistration within the required timeline, FTA may impose fines of up to a maximum AED 10,000.

Required Documents for VAT Deregistration:

| Documents Required | Sub-Reason | Basis for de-registration |

| Cancelled Trade license copy, liquidation letter, Board resolution

|

Cancellation of the license

|

Business has stopped making taxable supplies

|

| Latest financial statement of the business – Trail Balance, P&L statement, or Balance Sheet (Audited or Unaudited) | ||

| A letter from the Ministry of Labour confirming the total number of employees | ||

| Old as well as amended sales contract or license | Sale of license | |

| Amended company set-up contract | ||

| Template for financial turnover | ||

| Confirmation of total number of employees in a letter issued by the MOL (Ministry of Labor) | ||

| Document confirming that the business has officially stopped its activities | Natural person | |

| Template for financial turnover | ||

| Official letter and declaration which clearly explains and confirms that the person will not make any taxable supplies in the next 1 month or 30 days. | ||

| A chart outlining the business operations, including suppliers, importers, and the countries where both customers and suppliers ar located | The company is providing supplies that are either outside the scope of VAT or exempt | |

| Template for financial turnover | Below the voluntary registration limit | Business making taxable supplies below voluntary registration threshold limit of AED 187,500 |

| Latest financial statement of the business – Trail Balance, Income Statement, or Balance Sheet (Audited or Unaudited) | ||

| A signed and stamped letter on the company’s letterhead confirming that the business will not cross the VAT registration limit in the next 30 days | ||

| Template for financial turnover | The company is making supplies that are outside the scope of VAT or exempt | |

| Latest financial statement of the business – Trail Balance, P&L, or Balance Sheet (Audited or Unaudited) | ||

| A signed and stamped official letter confirming that the business has no operations in UAE. | ||

| A chart outlining the business operations, including suppliers, importers, and the countries where both customers and suppliers are located | ||

| Sample of invoices | ||

| Template for financial turnover | Revenues exceed the voluntary registration limit but below the mandatory registration limit | Business making taxable supplies exceeding the voluntary registration threshold limit of AED 187,500 but below the mandatory registration threshold limit of AED 375,000 |

| A dated and stamped official letter confirming that the business will not exceed VAT registration threshold in the next 30 days | ||

| Provide the TRN details that is being used | Duplicate TRN | Others |

| Attach a signed and stamped official letter from the company confirming that VAT returns will be submitted using the provided TRN | ||

| Tax Registration Number Certificate or TRN of the Head Office | Branch | |

| A confirmation on the company’s letter head with company stamp, also the website, confirming that parent company’s TRN shall be used for submitting VAT declarations. | ||

| An official letter with signature and stamp (if the registration is for a natural person then stamp is not needed), listing all individually registered VAT entities along with their TRNs, if any, and confirming that all declarations will be submitted under each individual registration. | Individual institution | |

| Template for financial turnover |

Also Read: Step-by-Step Guide to Register for VAT in UAE

Last Modified: