Step-by-Step Guide for Corporate Tax Registration in UAE

Corporate tax registration is compulsory for every business in the UAE that holds a commercial license. After the UAE introduced Federal Corporate Tax, every taxable business, including mainland companies, free zone businesses, and foreign companies is required to register for corporate tax. To register for corporate tax, complete the processes through EmaraTax portal.

It is crucial to understand what documents are required, what are the key deadlines, and what are the steps you must follow during the registration process. In this corporate tax registration guide, applicable for both companies and natural persons, we will explain the whole process step by step, share key updates, and provide practical tips to enhance your corporate tax knowledge.

KEY POINTS

- Corporate tax registration is mandatory for all the juridical persons or companies, including mainland and free zone entities. The only exception is available for natural persons who must register for corporate tax once their revenue has exceeded AED 1 million during a calendar year (January to December) starting from or after 01-Jan-2024.

- Successful registration for corporate tax requires submission of several mandatory documents, such as, trade license, incorporation certificate, memorandum of association or articles of association of the company, passport and Emirates ID of the shareholders, business activities of the juridical person, financial year end details (can be checked from MOA), and contact details of the company.

- Corporate tax registration deadline for UAE Mainland and Free Zone companies is 3 months from the incorporation date, and 3 months after the financial year end date for foreign companies managed and controlled from the UAE.

- Late registration for corporate tax will result in a fine of AED 10,000 as per the Cabinet Decision No. 75 of 2023.

Understand the Corporate Tax Framework in the UAE

Before you start registration for corporate tax, you need to understand the basics of UAE corporate tax:

- Standard UAE Corporate Tax Rate: 0% tax on taxable profits up to AED 375,000, and 9% on taxable profits above AED 375,000.

- Small Business Relief: Businesses making less than or equal to AED 3m revenue during a tax period can elect for small business relief and will be treated as having 0% taxable profit, means no tax.

- Applicable Entities: All companies based in the UAE, free zone businesses, branches, and foreign companies with a presence in the UAE.

- Exempt Entities: Government entities, qualifying investment funds, certain natural resource businesses, and charitable organizations.

The corporate tax law is administered by the Federal Tax Authority (FTA), and registration is mandatory even if your company has zero taxable income. To learn more about corporate tax in general, its applicability on different types of companies, corporate tax rates, and much more, please refer to our comprehensive guide to corporate tax in UAE.

How to Register for Corporate Tax?

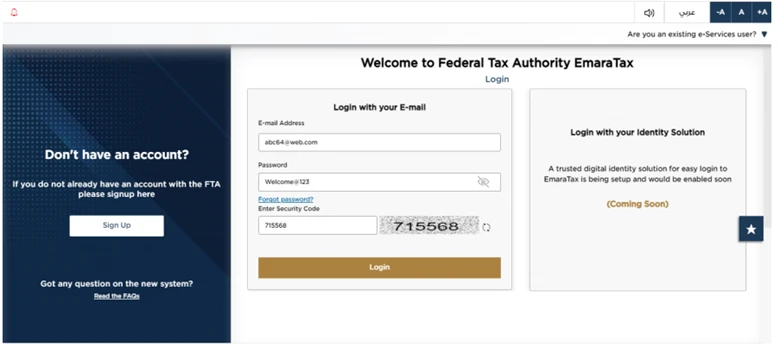

Step 1 – Set Up an EmaraTax Account

Go to the EmaraTax portal and create your account. It is completely free and takes about 10 to 15 minutes to complete the process. You can also login via UAE PASS.

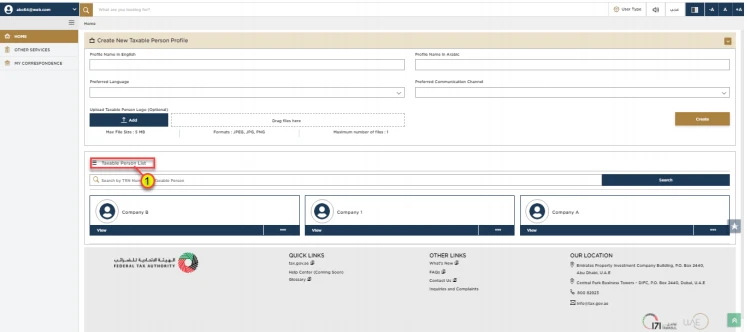

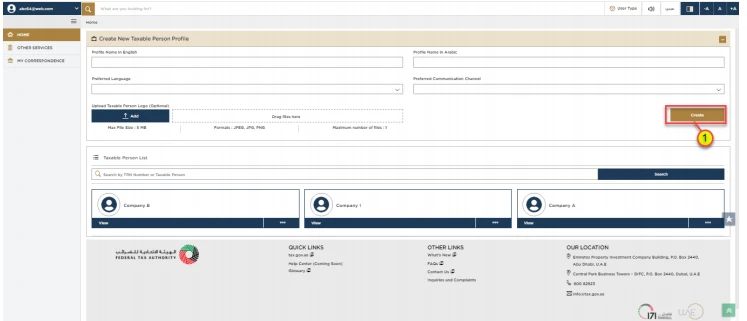

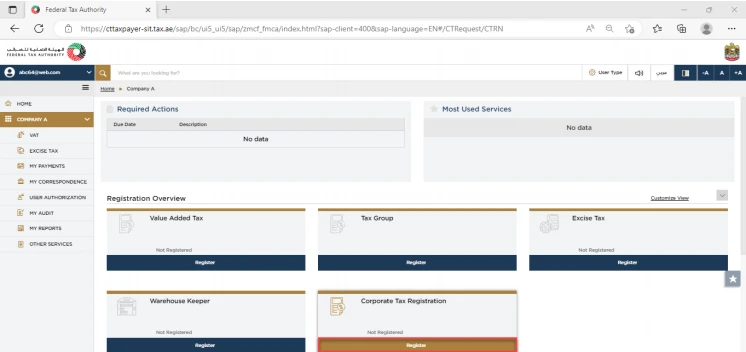

Step 2 – Add Your Business and Read the Instructions

Once you log in, you will see a taxable person list. Click on this list and it will show you if any taxable person is linked to your user profile. If you are a new registrant, this list will be empty and now you need to add your business as a taxable person. Once you have created the taxable person, go to the corporate tax section and choose the option for registration for corporate tax. The system will show you a checklist of the documents you need and FAQs to guide you through the process.

Note: FTA may sometimes change layout of the portal so the below visuals might have changed when you read this guide. But rest assured, the below options will be there. What you need to do is to search for these options on the portal.

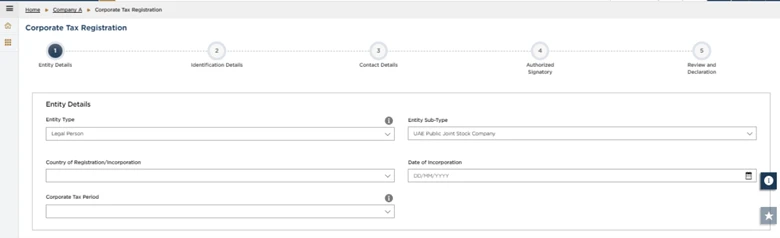

Step 3 – Fill in Business Details

Start by entering basic information about your company such as the type of business, the date it was established, and upload a copy of your incorporation certificate or trade license.

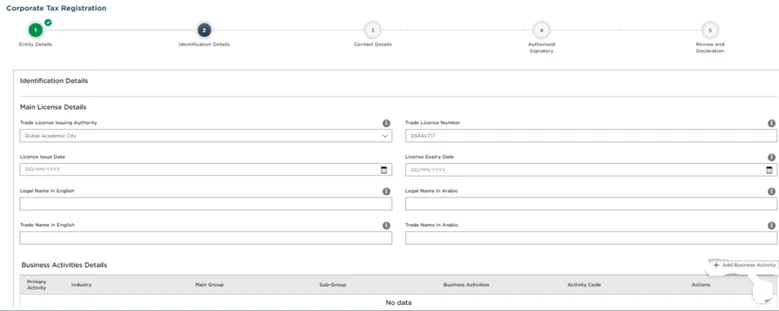

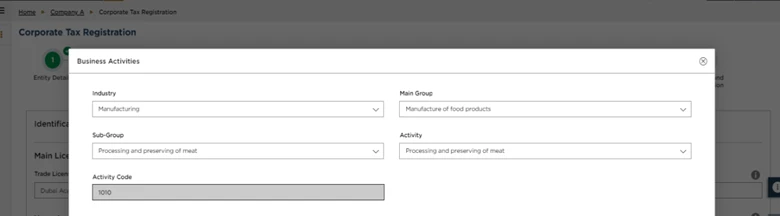

Step 4 – Enter Trade License Information

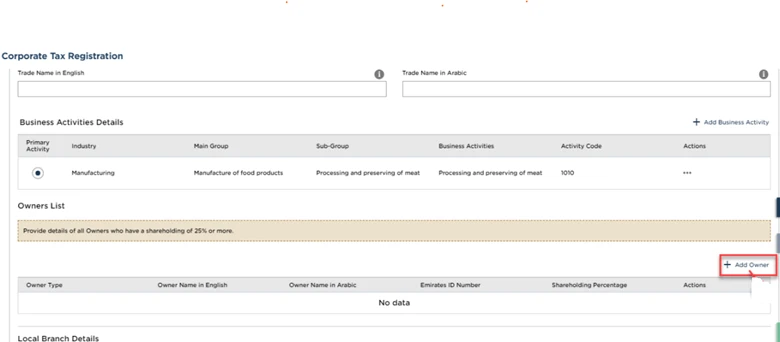

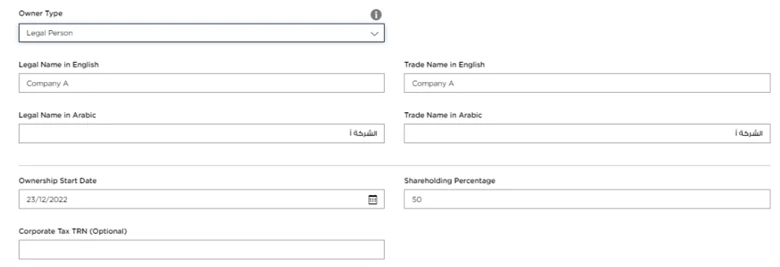

Next, provide details from your trade license, including your business activities and whether you have any branches. Upload a copy of the license and enter your company’s legal name in both English and Arabic. You must also add owners who hold 25% or more than 25% shares of the company.

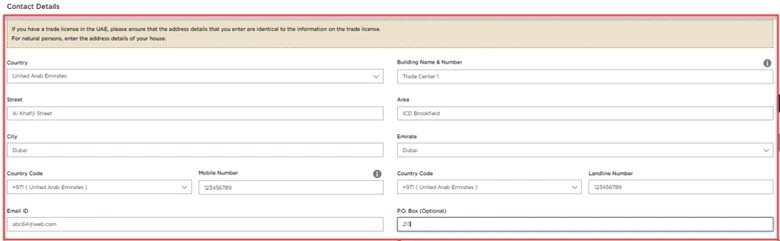

Step 5 – Provide Contact Information

Add your company’s official address, email address, and phone number so the Federal Tax Authority (FTA) can contact you if needed. Please note the address should be the same as mentioned on your trade license. If you have multiple addresses, then you should mention the address where most of your business activities are performed.

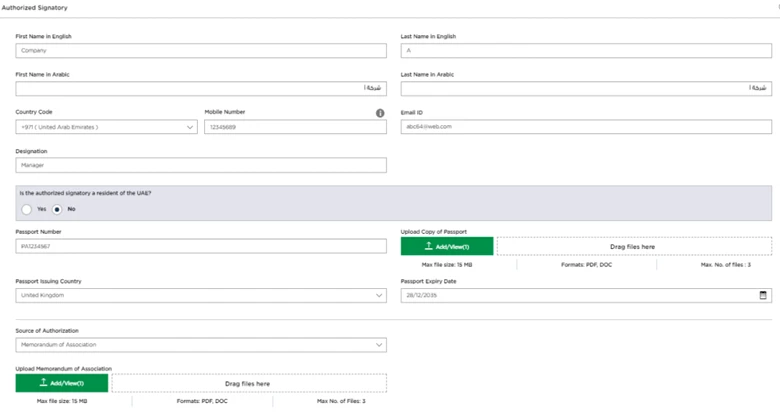

Step 6 – Appoint an Authorized Signatory

Choose an authorized person who will handle tax related matters for your company. You must disclose all the information about the authorized signatory including identity documents to the power of attorney or memorandum of association.

Step 7 – Check and Submit Your Application

Carefully check all the details and submit the corporate tax registration application. FTA can take from a few days to weeks to approve/reject your application.

Required Documents for Corporate Tax Registration in the UAE

- Valid Trade License

- Memorandum of Association (MoA) or Articles of Association (AoA) – to check financial year end details, shareholding, ownership, etc.

- Certificate of Incorporation

- Passport copies of owners/shareholders

- Emirates ID copies of owners/shareholders

- Company contact details

- Details of business activities

- Financial year end dates (counter check from the MOA as mentioned above)

Mistakes to Avoid When Registering for Corporate Tax

- Registering Late: If you miss the corporate tax registration deadline, you could be fined up to AED 10,000.

- Wrong or Missing Information: Always provide correct as well as complete details to avoid delays or rejection of your application.

- Poor Record-Keeping: Not keeping proper records can result in fines and may increase the chances of an audit.

- Uploading Poor-Quality Documents: Blurry or incomplete scans may be rejected by the Federal Tax Authority (FTA). So, keep in mind to upload clear pictures.

Corporate Tax Registration Deadline

The Federal Tax Authority gives registration deadlines based on when your trade license was issued. Businesses in UAE must register for corporate tax within 90 days of trade license issuance date. For example, if you receive your trade license in April 2025, you should complete your registration by the end of June 2025. To avoid fines and better understand the deadlines and tax rules, consult with a knowledgeable corporate tax expert.

After Registration: Corporate Tax Filing

Once your corporate tax registration has been approved, the next step is to ensure you follow all the corporate tax compliance requirements in your business transactions and prepare to file your corporate tax return on or before the deadline set by the FTA. To learn how to file the return, please refer to our corporate tax filing guideline.

Corporate Tax Deregistration

In the event your business ceases to exit or sold or is no longer meets the criteria to remain registered for corporate tax, you must apply for corporate tax deregistration. On time deregistration is mandatory to avoid administrative penalties. To learn how to deregister your business for corporate tax, read our step-by-step guide about corporate tax deregistration.

How Vertix Auditing Can Help?

Vertix makes corporate tax registration in the UAE quick and easy. Our team guides you through every step, from setting up your EmaraTax account to submitting all the required documents correctly. We also answer all the FTA Officer questions on your behalf and, if required, coordinate with their customer service too. We make sure your application is accurate and submitted on time, so you can avoid corporate tax penalties.

Changelog:

- 23 December 2025: Added additional information, including external source links and key summary notes.

- 12 January 2026: Added an internal link to UAE corporate tax penalties to help readers understand the administrative penalties in detail.

Last Modified: