Corporate Tax Deregistration in UAE

Similar to registration for corporate tax, corporate tax deregistration is also mandatory when a person (juridical/natural person) meets the required conditions to file an application for corporate tax deregistration in UAE. Below is a step-by-step guide to de-register your company for corporate tax in UAE:

KEY POINTS

- A juridical or natural person must file for corporate tax deregistration within 3 months after any of the following takes place:

a) the operations are permanently shut down or you are liquidating the company

b) you are selling or transferring the business or merging with another company

c) The legal form of your business has changed and the nature of change requires a new Tax Registration Number (TRN).

d) Natural persons may apply for deregistration if they have stopped performing business or business activities or their taxable revenue has gone below the registration threshold and it is expected to remain below the threshold. FTA may perform several procedures and checks to approve the deregistration.

| Type of Company | Corporate Tax Filing Deadline |

Triggering Event |

| Juridical/Legal Persons | 3 Months | Date of liquidation, shut down of operations, merger or acquisition, change of legal structure. |

| Natural Persons | 3 Months | Date of cessation of business activity or the date taxable income went below the registration threshold and expected to remain below the threshold. |

- You will need to file all the due corporate tax returns, pay any outstanding taxes and fines, and provide concrete evidence to justify why you want to deregister for corporate tax e.g. liquidation certificate, sale purchase agreement etc.

- Once the corporate tax deregistration application has been filed, FTA will take 30 business days to review your application. You may be asked to provide additional documents or information. After you provide additional documentation, FTA may take further 30 business days to review the additional documents. Please note that when FTA asks for additional information, you have to provide that within 60 calendar days to avoid rejection of deregistration application.

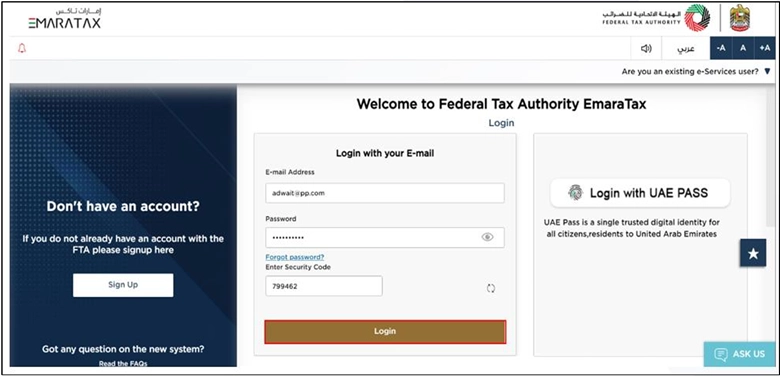

Login to Your EmaraTax Portal

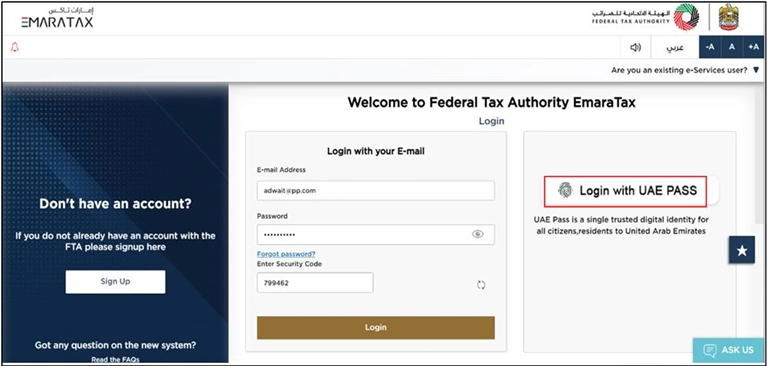

You can sign in to your EmaraTax account either with your username and password or through UAE Pass. If you are unable to remember your password, you can use the ‘Forgot password’ option to set up a new password for your account.

If you choose to log in with UAE Pass, you’ll be redirected to the UAE Pass portal. Once your signing-in process is completed, you will be redirected back to your EmaraTax dashboard.

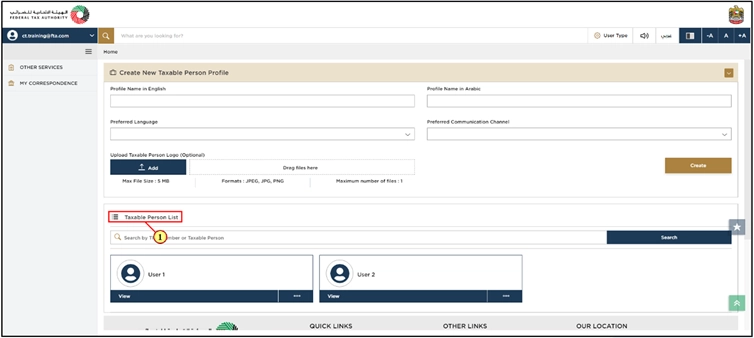

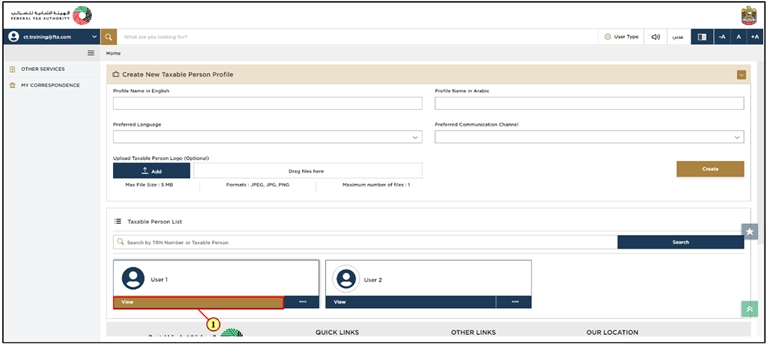

After you log in, you will see the Taxable Person list. This shows all the Taxable Persons connected to your EmaraTax profile.

Pick the Taxable Person from the list, then click ‘View’ to go to the dashboard.

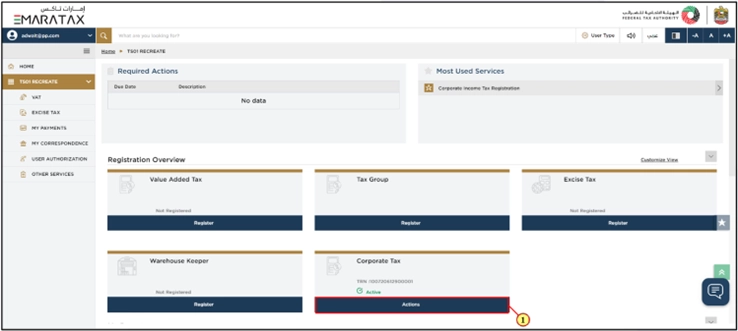

EmaraTax Account Dashboard for Taxpayers

To begin the Corporate Tax De-Registration process, open the Taxable Person Dashboard and choose ‘Actions’ under the Corporate Tax section.

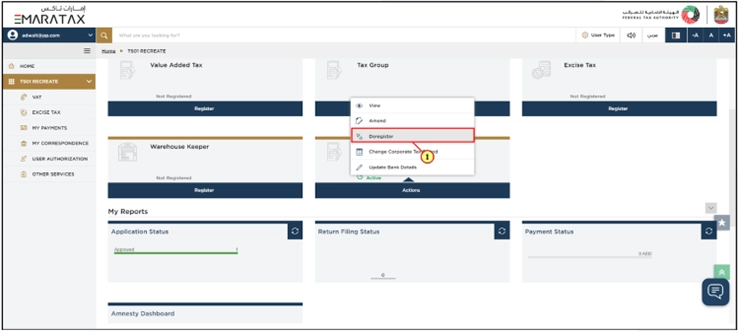

De-Register

Select ‘Deregister’ to begin the Corporate Tax Deregistration process.

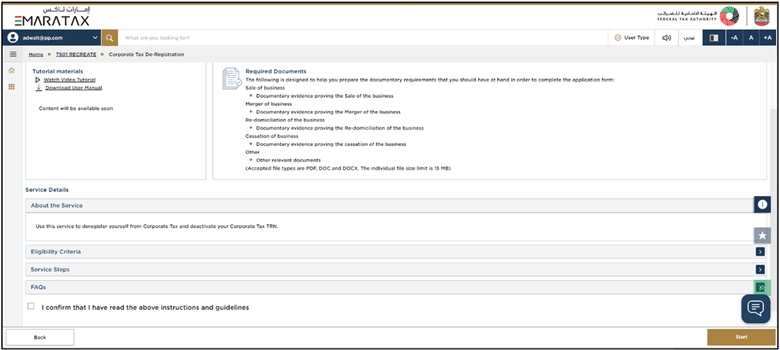

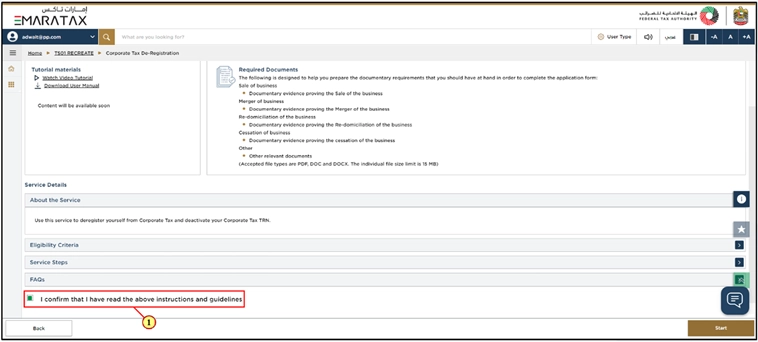

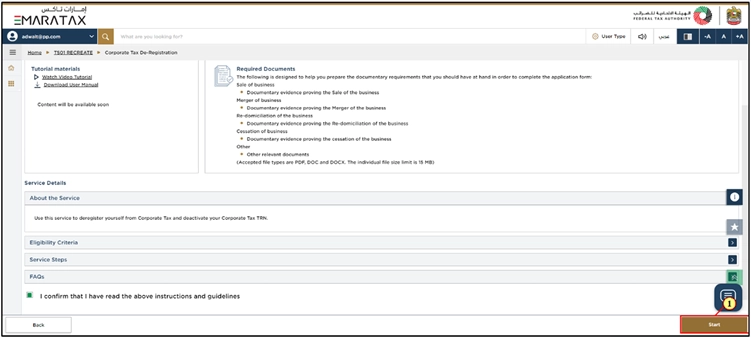

Instructions and Guidelines

The ‘Instructions and Guidelines’ page explains the key rules for Corporate Tax De-Registration in the UAE. It also tells you what details you need to prepare before filling out the De-Registration form.

Go through the details for Corporate Tax De-Registration and tick the box to confirm you have read them.

If you want to initiate the Corporate Tax De-Registration process, then click the ‘Start’ option.

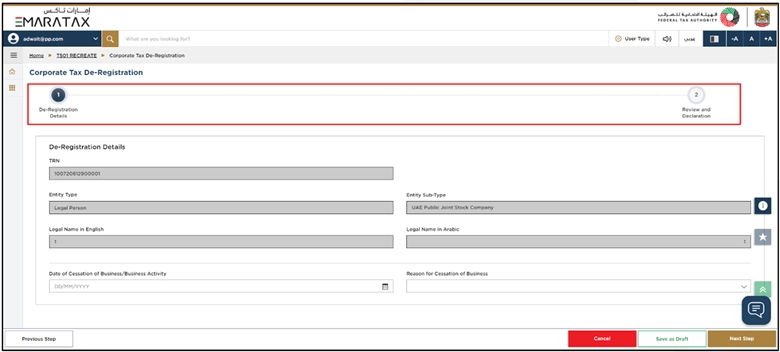

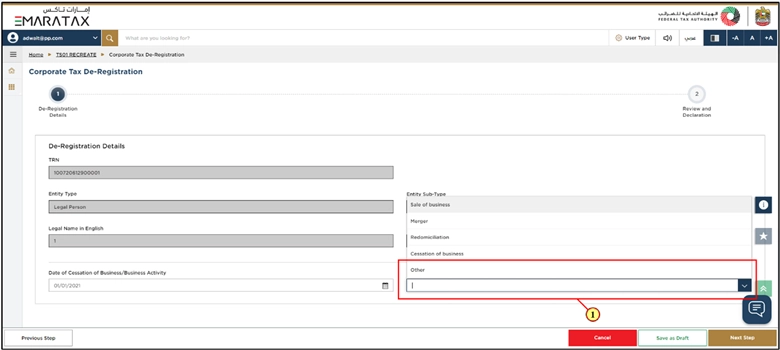

De-Registration Information

- The application has two sections, shown on the progress bar. The section you are working on appears in blue color, and once you complete your section, it turns green.

- You can only move to the next section after filling in all required fields. Fields that are not required are clearly labeled as optional.

- When you upload the documents, please make sure they contain the same information that you have provided in the form. If your documents are valid and real, there will be fewer chances of rejection.

- Your Corporate Tax registration details are already filled in automatically in the De-Registration form.

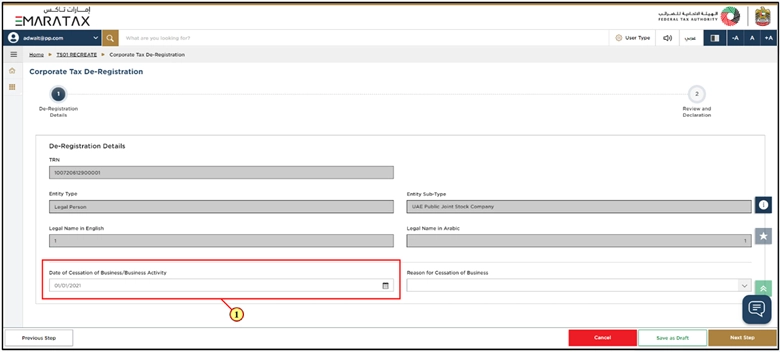

Enter the date your business stopped operating.

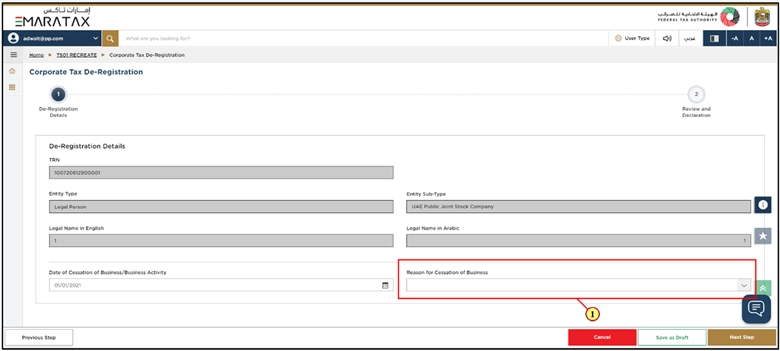

Choose the ‘Reason for Cessation of Business’ from the drop-down menu.

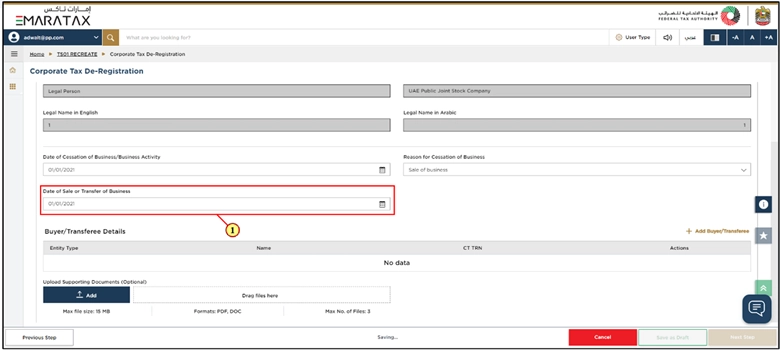

If you select sale of business, then the system will ask you to provide ‘Date of Sale or Transfer of Business’. If you have selected other, you will need to provide information about the same.

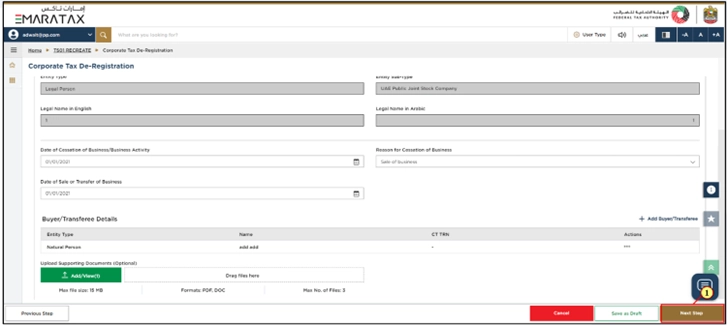

The below screen will open if you select sale of business option and then further details about the sale will need to be provided.

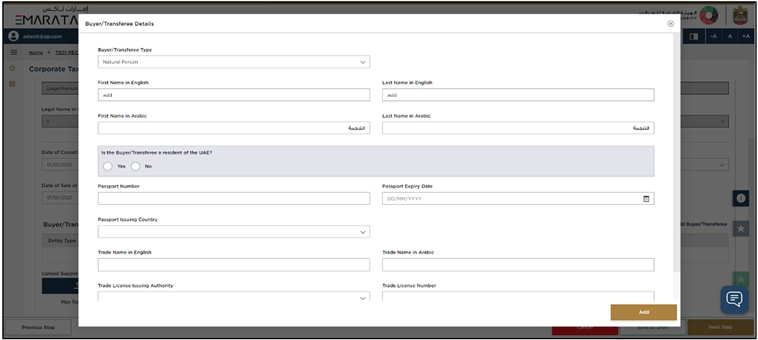

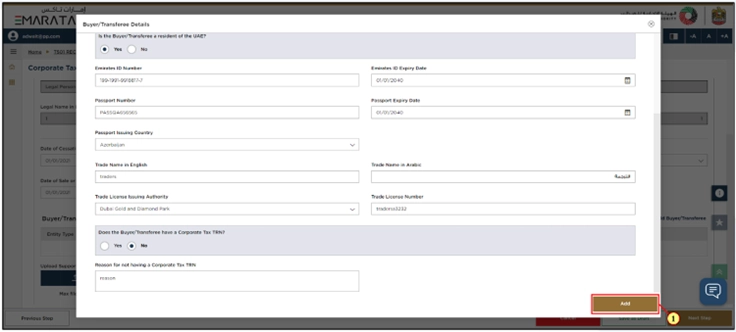

Add Buyer/Transferee

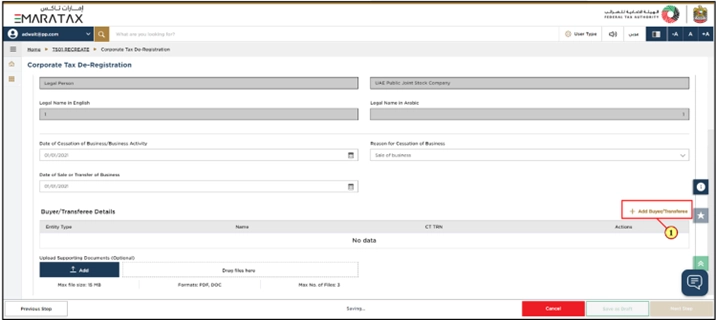

Click ‘Add Buyer/Transferee’.

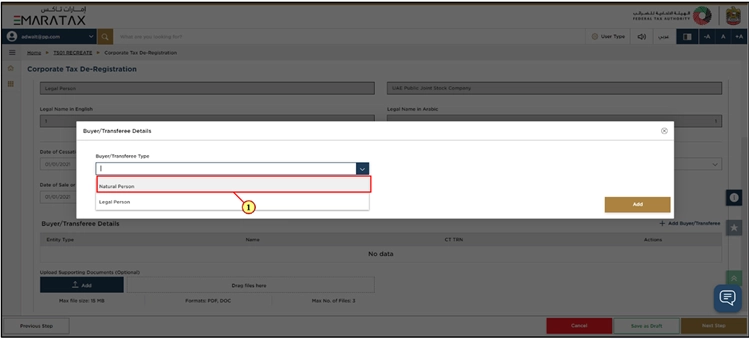

Choose ‘Natural Person’ or “Legal Person”. For the purpose of this guide, we will select “Natural Person”.

Add the details of Buyer

Fill in all required details and then click ‘Add’.

Once you have filled in the required details, click ‘Next Step’ to save as well as move to the following section.

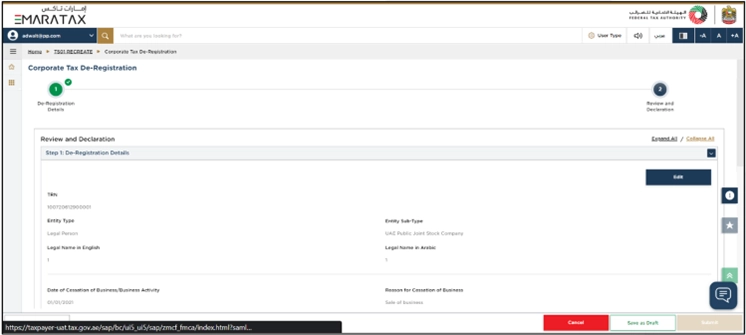

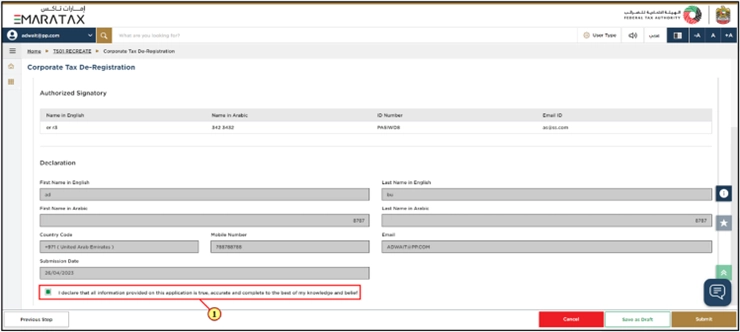

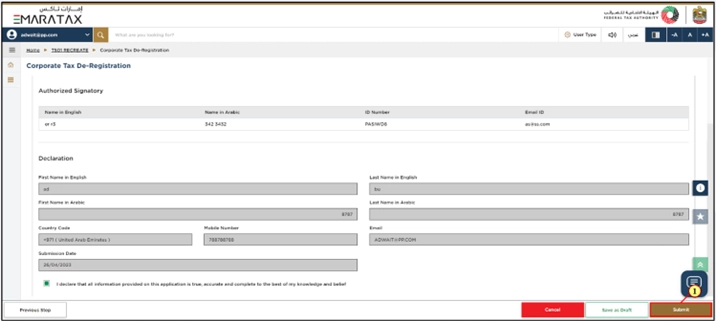

Review and Declaration

Here you can review the information you filled in for the application. Review the information carefully, then submit the application.

After checking all the details in the application, tick the box to confirm that the information you provided is correct.

Simply press submit button to send the application to FTA.

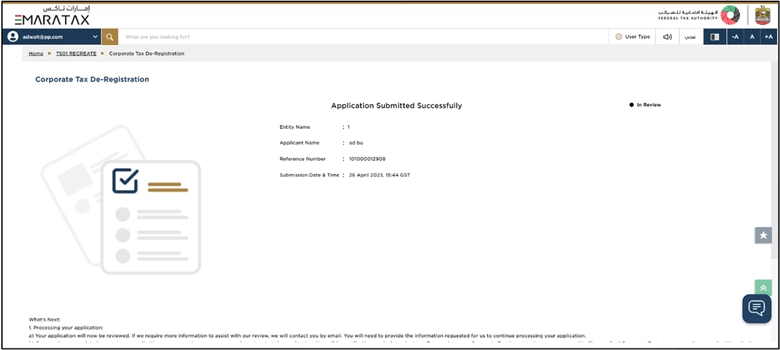

Post Application Submission

Once you submit your application for Corporate Tax De-registration, you will receive a Reference Number that is needed for future dealings with the FTA. So, you must keep the reference number safe with you.

Upload Required Documents

| Deregistration Reason |

Required Documents |

| Sales of Business | Any documentary proof confirming the business has been sold. This could include sale and purchase agreement, assignment agreement, board resolution approving the sale of business, share transfer, or amendment in the MOA. |

| Merger | Supporting documentation confirming the business has been merged with another company. This could include agreement of merger, board resolution approving the merger, or cancellation of trade license. |

| Re-domiciliation | Re-domiciliation means a company changes its jurisdiction without dissolution e.g. Re-domiciliation from JAFZA to RAK ICC. Evidence could include board resolution, Re-domiciliation application, or amendment in the MOA. |

| Cessation of the Business | Any evidence to proof the cessation of business like license cancelation application, communication with authorities, or board resolution. |

What Happens Next?

- If you submitted the corporate tax deregistration application on time, you will not be imposed with late deregistration penalties.

- Once you have successfully submitted your De-Registration application, the FTA reviews and either pre-approves, approves, or declines your submission based on the specific circumstances. Additionally, the FTA may request you to provide further supporting documents.

- You can track your application status anytime in the dashboard. When the FTA accepts your De-Registration form, you’ll receive a notification of the pre-approval.

- You may be asked to file a final tax return, which will be prepared through EmaraTax. The system will send you an email and SMS with your application status and instructions to clear any pending payments. To learn how to file final corporate tax return, please read our detailed guide about corporate tax filing.

- Your De-Registration will only be completed after you pay all taxes, penalties, and submit every required tax return, including the final one. If you have extra credit with the FTA, you’ll need to request a refund through EmaraTax.

- Check the sections titled ‘What Next’ as well as ‘Important Notes’.

Changelog:

- 12 January 2026: Added an internal link to UAE corporate tax penalties to help readers understand the administrative penalties in detail.

- 21 January 2026: Added summary points and tables to outline types of deregistration, events that trigger deregistration, and the documentary evidence to be uploaded to the FTA portal.

Last Modified: